Former U.S. President Donald Trump’s decision to roll back electric vehicle (EV) targets may slightly temper domestic demand for lithium and other critical minerals. However, analysts and industry leaders believe the global EV surge will keep the mining sector resilient.

Trump revoked his predecessor Joe Biden’s 2021 executive order that set a goal for 50% of new vehicles sold in the U.S. to be electric by 2030.

While the order had prompted automakers to prepare for a significant uptick in EV demand, Trump’s move has sparked uncertainty.

Shares of Japanese automakers, South Korean battery makers, and Australian, U.S., and Chinese lithium miners dipped following the rollback.

Trump also proposed measures to cut support for EVs and charging infrastructure while tightening restrictions on auto and battery material imports from China.

Despite these changes, analysts remain optimistic about long-term demand. Glyn Lawcock of Australian investment bank Barrenjoey commented, “Every time subsidies or benefits are reduced, it creates a dent in demand. But ultimately, global demand will grow even if the U.S. lags under Trump’s policies.”

Australian lithium producer Liontown Resources reaffirmed the global momentum toward EV adoption. CEO Antonino Ottaviano stated, “The transition to EVs is underway globally, with or without the United States. Longer term, demand will remain strong.”

China leads the EV market with 11 million annual sales, comprising 65% of global volume, while North America accounts for 20%.

The rest of the world, growing at a rapid 27% annually, is expected to surpass North America’s market share within two years.

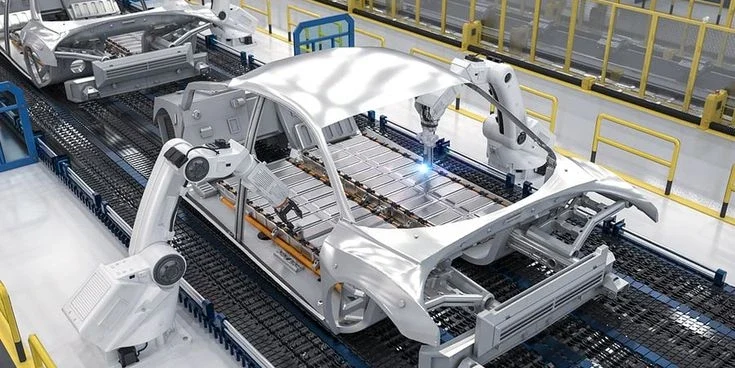

Beyond EVs, critical metals like lithium are essential for grid-scale energy storage, consumer electronics, and servers supporting artificial intelligence. This diverse demand is likely to sustain the mining industry.

Rio Tinto CEO Jakob Stausholm emphasized the bullish outlook for lithium during the World Economic Forum in Davos, stating, “Lithium demand could increase fivefold over the next 15 years, necessitating significant project development.” Stausholm, a longtime EV owner, added, “It’s just a better car.”

David Klanecky, CEO of Cirba Solutions, a private battery recycling firm, also projected a sharp rise in U.S. critical mineral demand by 2030, driven by EVs and electronics.

Western nations’ efforts to reduce reliance on Chinese supplies are expected to bolster support for critical minerals. Darryl Cuzzubbo, CEO of Australian rare earths developer Arafura, noted, “Measures to build supply chain independence from China will have a greater impact than the rollback of EV sales targets.”

He added, “There is a tipping point looming for electric vehicles where incentives will no longer be necessary to drive adoption.”

While Trump’s policy shift may slow EV adoption in the U.S., global growth trends and diversification of critical mineral applications ensure a robust future for the mining sector.

Industry leaders remain confident that the transition to sustainable technologies will continue to drive demand for lithium and other essential resources.