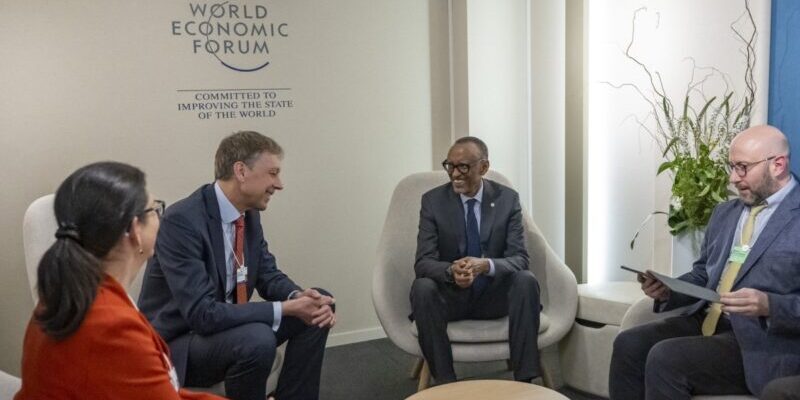

On the sidelines of the World Economic Forum in Davos, President Paul Kagame on Tuesday, January 16, met with Jakob Stausholm, CEO of mining giant Rio Tinto for a discussion on partnerships and investment opportunities in Rwanda’s mining sector, according to Village Urugwiro.

Rio Tinto, a global leader in the exploration, mining, and processing of minerals such as aluminium, copper, and lithium, has previously expressed interest in investing up to $7.5 million in the Rwandan sector.

In early August 2023, Rio Tinto, UK-based mining company Aterian, and Kinunga Mining signed a joint venture agreement to explore lithium in Rwanda.

As The New Times reported in August, the agreement indicates that Rio Tinto has the option to invest $7.5 million in two stages to earn up to a 75 per cent interest in the license to explore minerals vital for a successful energy transition to renewable energy.

The joint venture project has identified 19 pegmatite zones for lithium, caesium, and tantalum over 2,750 hectares in Southern Province.

Lithium is a key metal in the production of rechargeable batteries used in electric vehicles (EVs), laptops, and cell phones and is used in glass and ceramics.

n 2023, lithium demand was forecast to reach 900,000 tonnes, a 27 per cent increase from 2022, according to Benchmark Minerals, which assesses market prices and provides supply chain intelligence for lithium-ion batteries. Demand for lithium is forecast to be 1.5 million tonnes in 2026.

Mineral export revenues grew from $71 million in 2010 to over $772 million in 2022. Rwanda’s mining sector generated $851.6 million (approx. Rwf1 trillion) in export revenues from January to September 2023, representing an increase of 45.6 per cent compared to $584.8 million recorded during the same period in 2022.

The government targets $1.5 billion in annual mineral export revenues by 2024. Rwanda Mining, Petroleum and Gas Board says the country’s mineral reserves are valued at over $150 billion.