In 2019, France and Germany committed billions of euros to bolster Europe’s battery industry and compete with China and the US. Five years later, this ambitious effort is losing momentum.

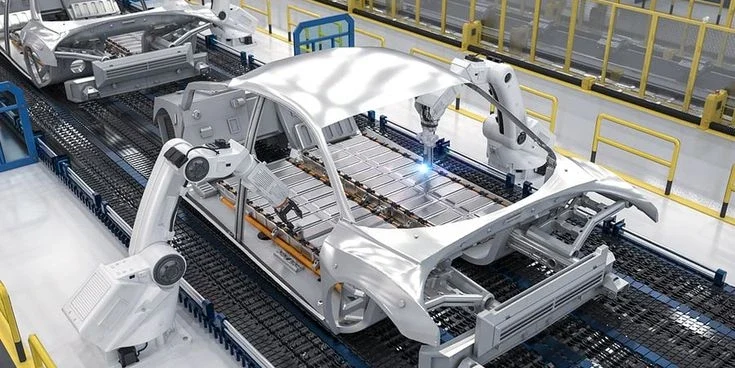

With electric vehicle (EV) sales slowing, major companies like Volkswagen, Stellantis, and Mercedes-Benz are scaling back or refocusing their battery projects.

Chinese manufacturers are cutting costs, and the US is attracting investment with substantial subsidies.

China, with its surplus battery-making capacity, can produce cells at a fraction of the cost in Europe and leads in next-generation cell technology.

This puts Europe at risk of falling further behind in the race to manufacture and power future EVs.

“As a European company, we need to change our mindset — we are transitioning from teachers to students to catch up on a significant backlog of experience,” said Sebastian Wolf, COO of Volkswagen’s PowerCo battery unit, at a conference in Stuttgart, Germany. “We need to focus on becoming faster and more cost-efficient.”

European companies face challenges accessing EU subsidies due to bureaucracy, leading to potential cutbacks in planned factories.

Volkswagen may delay reaching full capacity for its €20 billion battery project. Automotive Cells Company (ACC), led by Stellantis and Mercedes, has paused two of its three sites to consider making lower-cost cells due to slowing demand for expensive EVs.

Even Chinese players like Svolt Energy Technology Co. have canceled projects in Germany, citing subsidy uncertainties and the loss of key customers.

New entrants to the EV market face high competition from leading Asian suppliers. China’s Contemporary Amperex Technology (CATL), the world’s largest cell maker, has a site in Germany and is expanding in Hungary, while South Korea’s LG Chem has been producing batteries in Poland for about six years.

The Role of European Suppliers

Despite struggles, European suppliers have a crucial role in maintaining resilience, according to ACC’s CEO Yann Vincent. “It’s not to say that we are immediately competitive; there’s clearly an issue.”

The stakes are high: if Europe fails to establish its EV battery value chain, large parts of its automotive industry—which constitutes about 7% of Europe’s economy—could shift to Asia, similar to what happened with solar panels, consumer electronics, and chips.

China, which has been developing battery technology for decades, already controls over 80% of the market and leads on cost by a wide margin.

Recently, China improved the quality of cheaper battery cells that use no cobalt or nickel, prompting ACC to reconsider building lithium-iron-phosphate cells.

Northvolt, Europe’s biggest and most promising battery maker, is struggling to compete with the influx of cheaper Chinese batteries.

Meanwhile, aggressive subsidies and tax breaks in the US and Canada are attracting companies like Norway’s Freyr Battery to relocate.

The European Commission and the UK have approved less than €7 billion in state aid for battery manufacturing since 2022, a fraction of the estimated $140 billion needed to reach the target of 1.4 TWh of battery-manufacturing capacity by 2030.

The US plans to spend an estimated $160 billion in tax credits for solar and battery cells by 2029, while Canada committed $25 billion in battery incentives last year, attracting investments from Volkswagen and Stellantis.

“Europe needs to wake up and provide a decent response,” said Tom Einar Jensen, co-founder of Freyr Battery, at a BloombergNEF event.

“If Europe wants to move from reliance on Russian gas to reliance on Chinese imported batteries, that needs more consideration.”

Developing Self-Sufficiency

Developing self-sufficiency will be challenging. China not only leads in battery production but also dominates the supply chain, particularly in refining key minerals like lithium, nickel, cobalt, and graphite, as well as producing anode and cathode cell components.

Most of Europe’s investments have focused on cell manufacturing rather than mining and refining, said Ilka von Dalwigk, senior technology and policy expert at EIT InnoEnergy, a venture capital firm co-funded by the EU.

“Europe needs to develop a completely new industrial value chain and all parts simultaneously. We need to act quickly to secure market shares compared to US and Asian players.”

Without substantial support, new entrants face a bleak outlook. According to BloombergNEF, the world already has more than twice the lithium-ion battery capacity needed.

Manufacturing capacity in China, with its extensive incentives, was already three times domestic demand last year and is expected to rise to more than six times by 2025.

Herbert Diess, chairman of Infineon Technologies and former CEO of Volkswagen, suggested that Europe focus on complex solutions to integrate renewable energy into cars.

“We should do what we do best, and let China make what they do cheapest and with good quality,” Diess said.