In February, the Democratic Republic of Congo (DRC) imposed a four-month ban on cobalt exports, a measure now under review according to the country’s Minister of Mines, Kizito Pakabomba. He made the announcement on May 14 at the Cobalt Congress 2025 in Singapore.

At the time the ban was enacted, the country’s regulatory body for strategic minerals, Arecoms, stated that an assessment would be conducted three months into the measure, with possible adjustments or a full reversal depending on the findings.

With the ban set to expire on June 22, Kinshasa has yet to clarify its next move. At a March 14 Council of Ministers meeting, Prime Minister Judith Suminwa Tuluka proposed the introduction of export quotas as a strategy to “stabilize” the cobalt market.

However, no specifics were given regarding the quota volumes or implementation timeline.

There has also been no update on the DRC’s planned cobalt cooperation initiative with Indonesia, the world’s second-largest cobalt producer with a 9.66% market share.

Minutes from the May 14 Council meeting emphasized the need for “speed and efficiency” in implementing these initiatives.

President Félix Tshisekedi later hinted at a possible extension of the ban and spoke of “new strategies to ensure market balance and build the foundations for sustainable local industrialization,” though no details were disclosed.

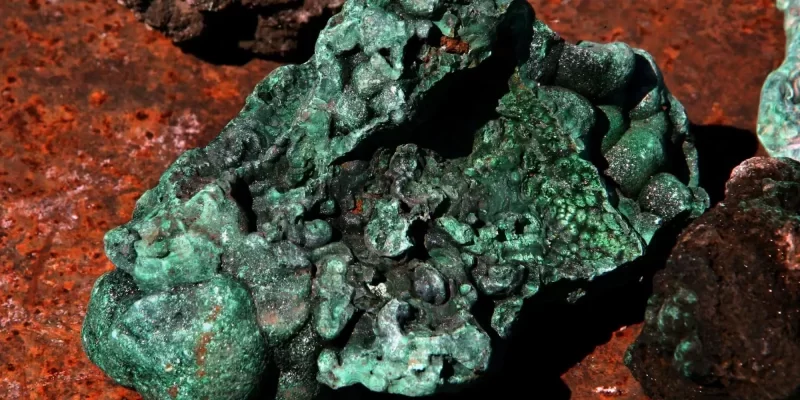

As the world’s top cobalt producer, responsible for over 70% of global supply, the DRC plays a pivotal role in influencing both market supply and prices.

The ban was introduced amid plummeting prices driven by overproduction in Congolese and Indonesian mines.

Since the measure took effect, cobalt prices have surged by more than 50%. On the London Metal Exchange, the price rose from $21,000 per tonne in late February to over $33,000 by mid-May, fuelled by stock reductions and uncertainty over DRC’s export policy.

Still, any indication that Congolese cobalt will soon return to the global market could trigger another price drop, particularly since key producers—China’s CMOC and Switzerland’s Glencore—have not halted production. Whether the government opts for quotas, an extension, or a new policy entirely, global attention will remain fixed on Kinshasa ahead of the June 22 deadline.