Cobalt is a strategic metal that is used in batteries, alloys, catalysts, and other applications. Zambia is one of the countries that produce cobalt, mainly as a by-product of copper mining.

In this article, we will review the cobalt production in Zambia and some of the major projects that are underway or planned.

Zambia is the world’s thirteenth-largest producer of cobalt, with output of 0.46kt in 2022, up by 5% in 2021. Over the five years to 2021, production from Zambia decreased by 18.35% and is expected to rise by 4% between 2022 and 2026. The main reason for the decline in production was the suspension of operations at Mopani Copper Mines (MCM), which accounted for about 80% of Zambia’s cobalt output.

MCM is a joint venture between ZCCM Investments Holdings (ZCCM-IH), a state-owned company, and Glencore, a multinational mining and trading company.

In April 2020, Glencore announced its intention to place MCM under care and maintenance due to low copper prices and COVID-19 disruptions.

However, this decision was opposed by the Zambian government, which threatened to revoke MCM’s mining license. After months of negotiations, ZCCM-IH agreed to buy Glencore’s majority stake in MCM for $1.5 billion in January 2021.

Since then, ZCCM-IH has been working to revive MCM’s operations and resume cobalt production. In May 2021, MCM announced that it plans to restart cobalt production in the second quarter of 2022, as prices for the metal surged to record highs due to strong demand from electric vehicle (EV) manufacturers. MCM also said that it would invest $300 million to upgrade its Nkana smelter and refinery, which will enable it to produce cobalt metal and sulphate, as well as copper cathodes and anodes.

Another major project that is expected to boost Zambia’s cobalt production is the Kalaba Copper-Cobalt Project, owned by Arc Minerals, a London-listed exploration and development company.

The project is located in the north-western province of Zambia, near the border with Angola and the Democratic Republic of Congo (DRC), which are the world’s largest cobalt producers.

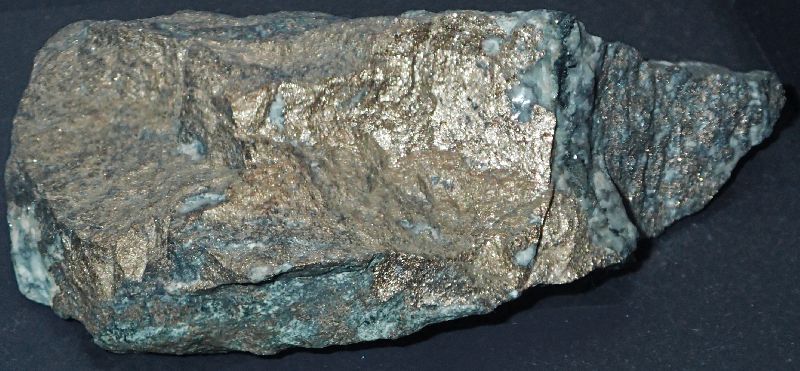

The project has a mineral resource estimate of 302kt of copper and 9.2kt of cobalt, with potential for further expansion.

Arc Minerals has been conducting drilling and metallurgical test work at the project since 2017, and has achieved positive results.

In June 2021, Arc Minerals announced that it has completed a feasibility study for the project, which confirmed its technical and economic viability.

The study envisages an open-pit mining operation with a processing plant that will produce copper-cobalt concentrate for export.

The project has a capital cost of $65 million and an operating cost of $1.35 per pound of copper equivalent. The project has a net present value (NPV) of $166 million and an internal rate of return (IRR) of 47%, based on a long-term copper price of $3 per pound and a cobalt price of $20 per pound.

I Zambia has significant potential to increase its cobalt production in the coming years, as new projects come online and existing ones resume operations. This will benefit the country’s economy and its position in the global cobalt market, which is expected to grow rapidly due to the rising demand for EVs and renewable energy sources.