The electric mining vehicle industry is projected to reach nearly $23 billion by 2044, according to a new report by IDTechEx.

The report highlights that large EV batteries and innovative fast-charging methods are propelling the adoption of electric and autonomous mining vehicles.

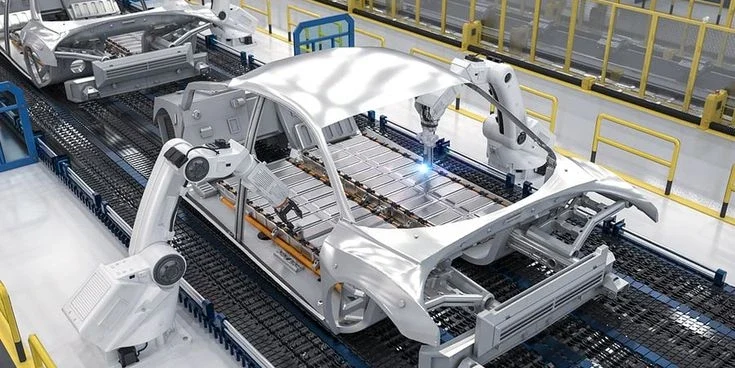

“Mining vehicles come in a wide range of sizes, so mining batteries can vary greatly too – from 100 kWh for light vehicles up to 2 MWh for large electric haul trucks.

The uniquely large nature of these batteries means they are only now becoming sufficiently developed and competitively priced,” the report states.

“Turnkey battery suppliers, including CATL, ABB, and Northvolt, have developed products particularly well-suited to mining vehicles, with ongoing development efforts.”

The report notes that lithium-nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP) batteries are currently used in mining.

Nearly 80% of mining vehicles utilize LFP batteries, despite their lower energy densities. This is not a significant issue as mining vehicles are already heavy and carry substantial ore loads.

“LFP excels in its cycle life. IDTechEx expects that some of the most demanding mining vehicles, such as haul trucks, will far exceed the cycle life of a single NMC or LFP pack, requiring multiple battery replacements.

Using a longer-life battery pack minimizes replacement frequency, making EVs more economical,” the report notes.

“Safety is another crucial factor, especially regarding fire safety in underground tunnels. LFP cells are generally considered safer, reducing risks to mine workers.”

Looking beyond NMC and LFP, IDTechEx anticipates the development of more battery technologies such as lithium-titanium-oxide (LTO) and sodium-ion (Na-ion), which could eventually become viable for mining vehicles.

The report emphasizes that extended downtime for charging has hindered EV adoption in the mining industry, impacting vehicle productivity.

However, progress has been made by original equipment manufacturers (OEMs) to reduce charging times to more familiar levels for mines.

“Conventional cable-based charging methods are commonly used, with most mining EVs utilizing DC fast charging. OEMs are now exploring multi-gun charging and megawatt charging systems to reduce times to between 20 and 60 minutes,” the report explains.

“While this increases productivity, charging at high rates can accelerate battery degradation and increase replacement frequency.”

Battery swapping is presented as an alternative to cable-based charging, particularly for underground vehicles.

This involves having two swappable battery packs per vehicle, allowing one to charge while the other is in use. Swapping can be completed in dedicated stations using a crane or hoist in as little as 5 to 10 minutes.

“Battery swapping is excellent for productivity but can be more expensive and requires dedicated space and infrastructure,” the report notes.

Dynamic charging, which involves charging vehicles in-cycle using power rails or overhead catenary lines along major pathways, is also being developed.

This method has the potential to eliminate charging downtime and maximize productivity but is still in the early stages of adoption.

“All of the above charging methods are likely to contribute to the industry’s electrification, with different methods suited to different vehicles based on their technical requirements and duty cycle demands,” the report concludes. “OEMs and charging providers are still optimizing their technologies.”